Cherry Payment Plans: Everything You Need

To Know About Cherry

10:05 pm

Ever found yourself eyeing that must-have item or essential service, only to sigh at the price tag? Here’s a

thought: what if stretching your budget was easier than you’ve been led to believe? Enter Cherry Payment

Plans, a game-changer in managing your finances while enjoying the finer things in life. This isn’t just about

spending; it’s about smart spending.

In this article, we’ll dive into the nuts and bolts of Cherry Payment Plans, exploring everything from what they

are and how they work to the myriad of advantages they offer for your treatments. Ready to revolutionize your

budgeting strategy?

Here’s what we’ll cover:

What Cherry Payment Plans are

Typical uses for Cherry Payment Plans

Advantages of using Cherry for your treatments

FAQs: From eligibility to impact on your credit score

Speaking of smart choices,Florida Concierge Medicine & Aesthetics (FCMA) has teamed up with Cherry to

ensure your journey to wellness and beauty is as smooth as your post-treatment skin. Because why

compromise on quality when you can have it all?

What Cherry Payment Plans Are

In a world where financial flexibility can make all the difference,Cherry Payment Plans stand out as a beacon

of hope for those looking to manage their expenses without compromising on the quality of care or products

they desire. Cherry offers a straightforward, innovative financing solution that allows patients and customers to

access the services or products they need now and pay over time.

Cherry’s model is designed with simplicity and accessibility in mind. Applying is quick and easy, requiring just a

few seconds to complete, with an instant decision following. This means no waiting around, wondering if you’re

approved. Once approved, you can immediately choose a payment plan that fits your budget, allowing you to

proceed with your purchase or treatment without delay.

Here’s a snapshot of what makes Cherry Payment Plans a smart choice:

High Approval Rates: Cherry boasts an industry-leading approval rate, making it more likely for you to get

the financial support you need.Immediate Funding: Once approved, the payment goes directly to the provider, ensuring they’re

compensated upfront. This means no hassle for you and no delay for them.Patient-Friendly Terms: With options like true 0% APR for up to 2 years, no hard credit check, and no

hidden fees, Cherry puts you first.Seamless Experience: The application process is fast, easy, and can be completed from anywhere,

providing a hassle-free way to secure financing.

Cherry Payment Plans are not just about easing the financial burden; they’re about removing cost as a barrier

to treatment. This approach aligns perfectly with the ethos at Florida Concierge Medicine & Aesthetics (FCMA),

where the focus is on providing top-tier care without financial strain. By partnering with Cherry, FCMA ensures

that you can prioritize your health and beauty, making decisions based on what’s best for you, not just what’s

affordable at the moment.

How Cherry Payment Plans Work: A Closer Look

Diving deeper into the mechanics of Cherry Payment Plans reveals a system designed for ease, efficiency, and

empowerment. Here’s How It Unfolds, Step By Step, ensuring you’re well-informed and ready to make the

best decision for your financial and personal well-being.

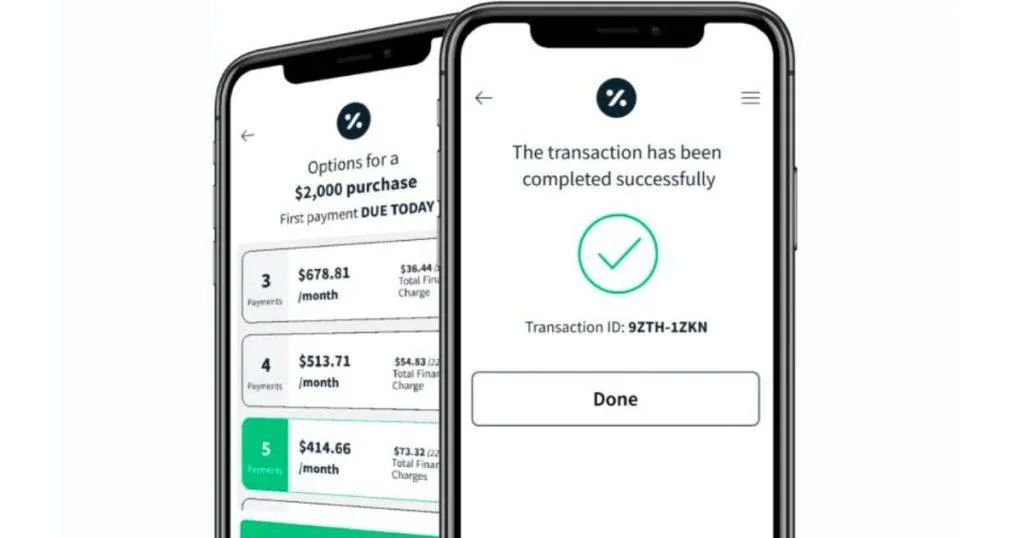

Step 1: Quick and Easy Application

The journey begins with a simple application process. You apply using a link exclusive to the practice or

merchant you’re dealing with, ensuring seamless integration with your intended purchase or treatment. This

application takes mere seconds to complete, and you’ll receive an instant decision. This rapid turnaround is

crucial, removing the anxiety of waiting and wondering.

Step 2: Instant Approval and Flexible Payment Options

Upon approval, the real magic happens. You’re presented with a variety of payment plans, allowing you to

select the one that best fits your budget and timeline. This flexibility is key to Cherry’s appeal, offering true 0%

APR options for up to 2 years on some plans, with no hard credit check and absolutely no hidden fees. It’s

transparency and flexibility rolled into one.

Step 3: Enjoy Your Purchase or Treatment with Peace of Mind

Once you’ve selected your payment plan, the provider receives full payment upfront from Cherry. This means

they’re not left waiting for their funds, and you’re not burdened with immediate financial strain. You can enjoy

your purchase or treatment right away, with the comfort of knowing your estimated payments are

manageable and tailored to your financial situation.

The Cherry Advantage: Making a Difference

Cherry Payment Plans are more than just a financial tool; they’re a pathway to accessing the care and products

you need, all without the stress of hefty upfront costs. Whether you’re eyeing medical treatments, aesthetic

procedures, or significant purchases, Cherry offers a solution that respects your financial reality. With flexible

payments, even those with an adverse financial history can move forward with their plans, thanks to Cherry’s

understanding approach.

No Down Payment Required: Cherry’s model often requires no down payment, making it easier to begin

your journey without financial strain. This approach, combined with promotional rates subject to approval,

ensures that more people can access the services they need.No Impact on Credit Score: Applying for Cherry does not affect your credit score, courtesy of a soft credit

check process. This means you can explore your financing options, including using a payment calculator to

plan ahead, without worry. Cherry qualifies clients based on a holistic view of their payment history, not

just a number.Empowerment to Choose: Cherry puts the power in your hands, allowing you to choose how and when

you pay, much like you would with a traditional debit card but with the benefits of a payment plan. This

empowerment is a game-changer in managing personal finances, especially for those concerned about

recent missed payments or their credit bureaus report.Seamless Integration: For providers like Florida Concierge Medicine & Aesthetics (FCMA), Cherry’s

system integrates smoothly, ensuring that discussing fees and financing is transparent and less of a

burden. This integration enhances the overall experience for both the provider and the client, allowing you

to pay monthly or at a pace that suits you best.

Incorporating Cherry Payment Plans into your financial strategy can transform how you approach significant

expenses, making it easier to prioritize your well-being and desires. With Cherry, you’re not just finding a way to

pay; you’re unlocking the potential to enjoy life’s offerings on your terms, with the added peace of mind that

comes from flexible and understanding financing options.

The Advantages of Using Cherry for Your

Treatments

Choosing Cherry Payment Plans for financing your treatments or purchases brings a host of benefits that go

beyond mere financial flexibility. It’s about empowering you to make decisions that align with your needs and

desires without the immediate pressure of cost.

Let’s explore the key advantages that make Cherry a standout choice for managing your expenses.

Immediate Access to Care and Products: With Cherry, the barrier of cost is significantly reduced, allowing

you to access the treatments or products you need right when you need them. This immediate access is

not just convenient; it’s transformative, enabling you to prioritize your health, beauty, and overall well-

being without delay.Tailored Payment Plans: Cherry understands that one size does not fit all when it comes to financing.

That’s why they offer a variety of monthly payment plans, including true 0% APR options for up to 2 years

on some plans. This flexibility allows you to choose a plan that fits your budget and payment preferences,

making it easier to manage your finances without compromising on the quality of care.A Streamlined, Stress-Free Process: From application to approval and payment, Cherry’s process is

designed to be as smooth and stress-free as possible. The quick application, instant decision, and direct

payment to providers mean you can focus on what truly matters—your treatment or purchase—without

worrying about the financial logistics.Enhancing Your Treatment Options: For clients of Florida Concierge Medicine & Aesthetics (FCMA) and

similar providers, Cherry Payment Plans open up a world of possibilities. Whether you’re considering

aesthetic enhancements, medical treatments, or wellness services, Cherry’s financing options mean you

can pursue a broader range of treatments without financial strain.Building Your Credit Responsibly: Cherry’s approach to financing, which includes no hard credit checks

for application and flexible payment terms, allows you to manage your payments responsibly. This can be

an excellent way to build or maintain your credit score, as timely payments are reported positively.

Cherry in Action: A Case Study

Consider the story of Catherine Casas, a client at FCMA, who dreamed of undergoing a series of aesthetic

treatments to boost confidence but was hesitant due to cost. By choosing Cherry Payment Plans, Catherine

was able to schedule the entire treatment series without the upfront financial burden. The flexibility of Cherry’s

payment options allowed Catherine to manage the expenses comfortably, leading to a transformative

experience that was both empowering and life-enhancing.

FAQs

What is a Cherry Payment Plan?

Cherry Payment Plans offer a flexible financing option for consumers looking to spread the cost of their

purchases or treatments over time. With Cherry, you can access immediate funding for services or products,

choosing a repayment plan that fits your budget.

How Does the Cherry Payment Plan Work?

Applying for Cherry is quick and straightforward. Once you apply and are approved, you select a payment plan

that suits your financial situation. Cherry pays the provider upfront, and you repay Cherry over time according

to the terms of your plan.

Is Cherry Payment Plan Legit?

Absolutely. Cherry Payment Plans are a legitimate financing option, offering a transparent and consumer-

friendly way to manage large purchases or treatment costs. With high approval rates and positive reviews,

Cherry is trusted by both consumers and providers.

What Credit Score Do You Need for the Cherry Payment Plan?

Cherry offers financing options that cater to a wide range of credit scores. They perform a soft credit check that

doesn’t impact your credit score, making it easier for a broader audience to qualify for financing.

Is It Hard to Get Approved for Cherry Financing?

No, it’s not hard to get approved. Cherry boasts a high approval rate, thanks to their inclusive approach to

financing. The application process is designed to be quick and easy, providing instant decisions to applicants.

Does Cherry Payment Affect Credit Score?

Applying for Cherry involves a soft credit check, which does not affect your credit score. However, like any

financing option, responsible management of your payment plan can positively impact your credit score over

time.

Do Payment Plans Lower Credit?

Not inherently. Payment plans can actually help you build or maintain your credit score, provided you make

your payments on time. Timely payments are reported positively, while late or missed payments can negatively

affect your score.

Is There a Downside to Payment Plans?

The primary consideration with any payment plan is ensuring the monthly payments fit within your budget.

While Cherry offers flexible and often interest-free options, it’s important to choose a plan you can comfortably

afford to avoid financial strain.

Does It Hurt Your Credit to Make Multiple Payments a Month?

Making multiple payments in a month can be a positive way to manage your debt, as it may reduce your

overall interest paid and can keep your account in good standing. It does not hurt your credit score to make

multiple payments.

Cherry Payment Plan Reviews

Cherry Payment Plans have received positive feedback for their ease of use, flexibility, and the financial

freedom they offer consumers. By allowing users to spread the cost of their purchases over time, Cherry helps

make treatments and products more accessible.

Patients – Cherry Payment Plans: “Cherry was great, one of the better lending companies I’ve ever used.

Making payments was a lot easier and I appreciate Cherry willing to work with me.”Read MoreCherry Financing Reviews on TikTok: Exciting news shared about offering financing options through

Cherry and CareCredit, highlighting the ability to achieve goals without the upfront cost and inviting users

to learn more.Explore On TikTokCentral Pacific Bank – Cherry Payment Plans: This page discusses the benefits of offering Cherry

Payment Plans to patients, allowing purchases between $200 – $25,000 to be split into smaller, more

manageable monthly payments.Learn More

These snippets provide a glimpse into the positive impact Cherry Payment Plans have on easing financial

burdens and enhancing customer experiences.

Make Your Wellness Journey Effortless with Cherry

Navigating your path to wellness and beauty has never been more accessible, thanks to Cherry Payment Plans.

You’ve now got the insider scoop on how Cherry can transform your approach to managing expenses, making

every step of your journey smooth and stress-free.

Cherry offers quick, easy applications with instant decisions.

Flexible payment options tailor your financial plan to your needs.

Enjoy immediate access to treatments and products without upfront stress.

Cherry’s seamless process and partnership with providers enhance your experience.

As you consider your next steps towards health and beauty, remember that Florida Concierge Medicine &

Aesthetics (FCMA) seamlessly integrates Cherry Payment Plans into your care. This partnership ensures that

your journey to radiant skin and overall wellness is not just a dream but a reality within reach. With FCMA and

Cherry, you’re set to embark on a transformative journey that respects both your wellness goals and your

budget.

BOOK A FREE

CONSULTATION

Our Aesthetic Experts are ready to help you

achieve your cosmetic goals!

Book a free consult with us and experience the

FCMA Med Spa difference.

LET US TAKE

CARE OF YOU

VISIT US

5555 Hollywood Blvd,

Suite 201

Hollywood, FL 33021

(954) 932-3269

WORKING HOURS

Monday – Friday

08:00 PM – 05:00 PM

Saturday – Sunday – Closed

QUICK LINKS

NEWSLETTER

Stay up to date with our monthly specials and giveaways!

© 2024 FCMA. All Rights Reserved.